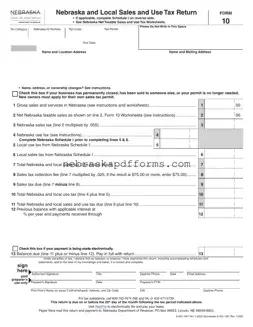

The Nebraska 10 form is a crucial document for reporting sales and use tax in the state of Nebraska. This form allows businesses to accurately report their gross sales, net taxable sales, and the corresponding tax amounts due. Completing the...

The Nebraska 1040N form is the state income tax return used by residents, partial-year residents, and nonresidents to report their income and calculate their tax liability for Nebraska. This form is essential for individuals who earned income in Nebraska during...

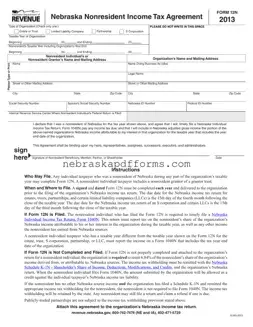

The Nebraska 12N form is a Nonresident Income Tax Agreement that allows nonresident individuals to report their share of income from certain organizations in Nebraska. By completing this form, taxpayers can ensure compliance with Nebraska tax laws while accurately reporting...

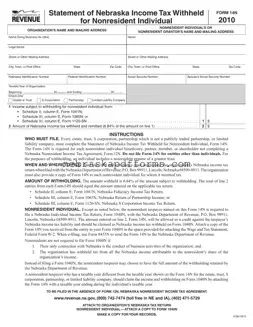

The Nebraska 14N form is the Statement of Nebraska Income Tax Withheld for Nonresident Individuals. This form is essential for estates, trusts, S corporations, partnerships, and limited liability companies that have nonresident beneficiaries or members. Accurate completion and timely submission...

The Nebraska 17 form is a document that allows a governmental unit or exempt organization to appoint a prime contractor as its purchasing agent for building materials related to a tax-exempt construction project. This form must be completed before any...

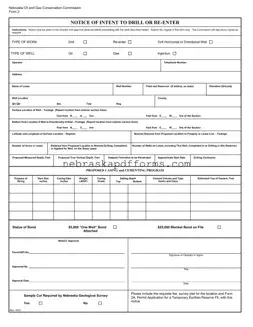

The Nebraska 2 form, officially known as the Notice of Intent to Drill or Re-Enter, is a crucial document required by the Nebraska Oil and Gas Conservation Commission. This form must be submitted to obtain approval before any drilling or...

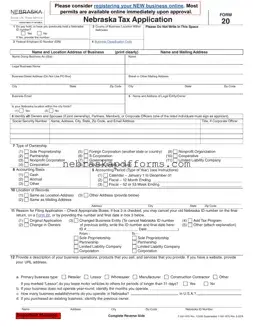

The Nebraska 20 form is a tax application used by businesses to register for various tax programs in the state. This form allows new businesses to establish their tax identification and comply with Nebraska's licensing requirements. If you're ready to...

The Nebraska 22 form is a request used by taxpayers to change their name or address associated with various tax certificates, licenses, or permits. This form is essential for maintaining accurate records with the Nebraska Department of Revenue and can...

The Nebraska 2210N form, known as the Individual Underpayment of Estimated Tax, is a crucial document for individuals who may not have paid enough state income tax throughout the year. By completing this form, taxpayers can calculate any penalties due...

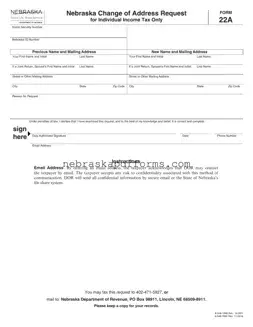

The Nebraska 22A form is a document used to request a change of address for individual income tax purposes in Nebraska. This form allows taxpayers to update their mailing information, ensuring that they receive important tax-related correspondence. Completing the Nebraska...

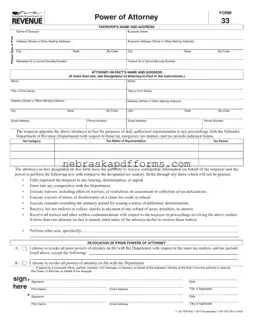

The Nebraska 33 form, also known as the Power of Attorney, allows a taxpayer to appoint an attorney-in-fact for representation in tax matters before the Nebraska Department of Revenue. This form grants the designated individual the authority to handle confidential...

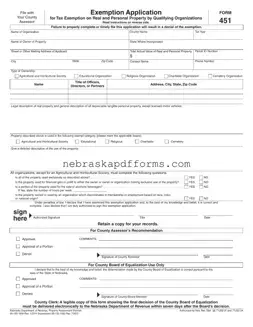

The Nebraska 451 form is an application used by qualifying organizations to request a property tax exemption on real and personal property. This form is essential for organizations such as educational, religious, and charitable entities that meet specific criteria. Completing...