Nebraska 22 Form

The Nebraska 22 form serves as a vital tool for taxpayers needing to communicate changes related to their business tax obligations. This form is essential for individuals and businesses that are altering their name or address, correcting or canceling certificates, licenses, or permits, or changing their filing frequency for various tax programs. It accommodates a range of tax programs, including sales tax, income tax withholding, and lodging tax, among others. The form requires the taxpayer to provide their Nebraska ID number, federal employer ID number, and details regarding the nature of the request. Additionally, it allows for the reporting of changes in business ownership or partnerships. Accurate completion of the Nebraska 22 form is crucial, as it ensures that the Nebraska Department of Revenue can update records accordingly and maintain compliance with state tax regulations. By following the outlined instructions, taxpayers can effectively manage their tax-related changes, ensuring a seamless transition and continued compliance with state requirements.

Document Preview Example

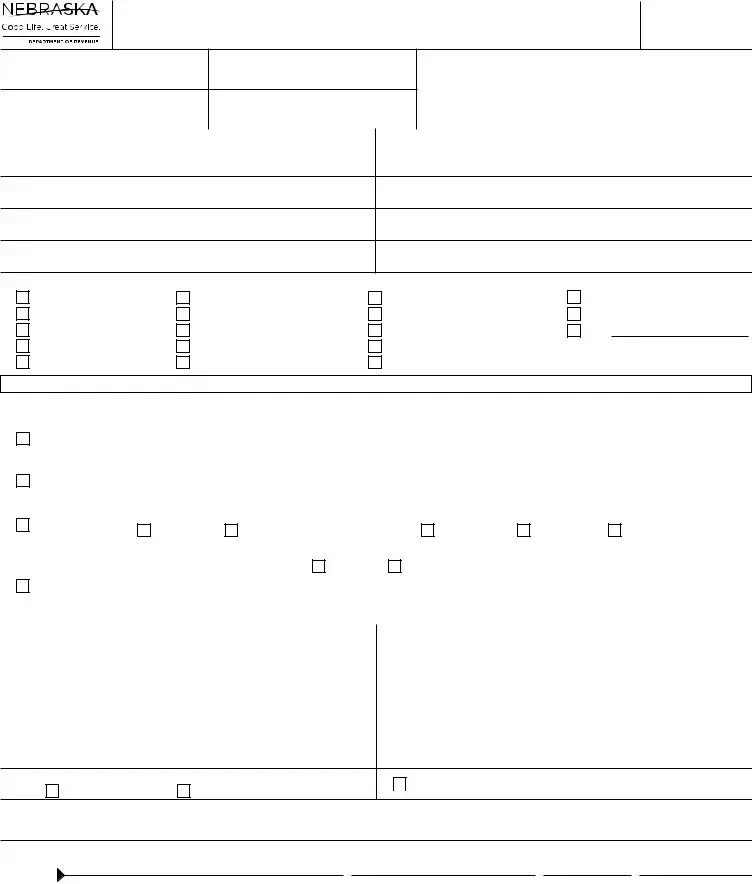

Nebraska Change Request

Use Form 22A for individual income tax name/address changes.

FORM

22

1Nebraska ID Number

3County of Business Location in Nebraska (if applicable)

Please Do Not Write in This Space

2Federal Employer ID Number

4Business Classification Code

Name and Location Address |

Name and Mailing Address |

Names on your Certificate, License, or Permit |

Names on your Certificate, License, or Permit |

Address (Number and Street)

Street or Other Mailing Address

City |

State |

Zip Code |

City |

State |

Zip Code |

5Check All Tax Programs Affected by Request:

Sales Tax (01)

Retailer’s Use Tax (02)

Use Tax (04)

Prepaid Wireless Surcharge (19) Income Tax Withholding (21)

Fiduciary Income Tax (23)

Corporation Income Tax (24)

Financial Institution Tax (24)

Partnership Income Tax (25)

Severance and Conservation Tax (45)

Wholesale Cigarette Dealer (47) Tobacco Products (56)

Unstamped Cigarette Transporter (63)

Waste Reduction & Recycling Fee (64)

Tire Fee (66)

Litter Fee (67)

Lodging Tax (68)

Other

Indicate Type of Action Requested by Checking Appropriate Boxes Below

If you have a change in the ownership of your business, or have obtained a different federal employer ID number, you must cancel your certificates,

licenses, and permits. The new entity must file a Nebraska Tax Application, Form 20, to obtain its own certificates, licenses, and permits.

6 |

Cancellation |

Date of Last Transaction |

|

|

|

|

|

|

Location of Records |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Month _______ Day________ Year _______ |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||

|

Reinstatement |

Date of Reinstatement |

|

Year the Account was |

|

Location of Records |

|

|

||||

7 |

|

|

Cancelled |

|

|

|

|

|

||||

|

|

Month _____ Day _____ Year _____ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Returns are Presently Filed: |

|

|

|

|

|

Request Permission to File Future Returns: |

|

|||

8 |

Change in |

Monthly |

Quarterly |

|

|

|

Annually |

|

Monthly |

Quarterly |

Annually |

|

|

|

|

|

|||||||||

|

Filing Frequency |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Average Annual Tax Liability |

|

Average is Based on: |

|

|

Number of Months Used to Compute Average |

|||||

|

|

$ |

|

|

|

Estimate |

Reported Amounts |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

9

Change in Name and Address

If you are changing the names or addresses on your certificates, licenses, or permits (for example, due to a name change, relocation, or correction, and not from a change in ownership or federal ID number), please complete the following information.

New Name and Location Address of Business |

|

New Name and Mailing Address |

|

||

|

|

|

|

|

|

Name Doing Business As (DBA) |

|

|

Name |

|

|

|

|

|

|

|

|

Business Legal Name |

|

|

|

|

|

|

|

|

|

|

|

Business Address (Number and Street) |

|

|

Street or Other Mailing Address |

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

City |

State |

Zip Code |

10Is this a Nebraska location within the city limits?

|

|

|

11 |

|

Change in Officers, Members, or Partners (Attach list. See instructions.) |

(1) |

Yes |

(2) |

No |

|

|

|

|

12Reason for Request

Under penalties of law, I declare that I have examined this request, and to the best of my knowledge and belief, it is correct and complete.

sign here

Signature of Owner, Partner, Member, Corporate Officer, or |

Title |

Date |

Phone Number |

Authorized Individual |

|

|

|

|

|

|

|

Email Address |

|

|

|

You may fax this request to

revenue.nebraska.gov,

Retain a copy for your records.

Instructions

Who Must File. A Form 22 should be filed by any taxpayer who:

•Has a name or address change;

•Needs to correct, cancel, reinstate, or change a Nebraska tax certificate, license, or permit;

•Needs to change the filing frequency for sales and use tax, tire fee, lodging tax, or income tax withholding returns; or

•Needs to report a change in officers, members, or partners of the business or organization.

One request may be used to correct, cancel, or change more than one certificate, license, or permit held by the taxpayer for the tax programs listed, provided the Nebraska ID number is the same. Nebraska Change of Address Request for Individual Income Tax Only, Form 22A, should be used for individual income tax name and address changes.

When and Where to File. Mail to the Nebraska Department of Revenue, PO Box 98903, Lincoln, NE

Permanently Closing the Business. Form 22 should be filed to cancel one or more of the tax programs listed in line 5. You are required to file all tax returns for tax periods through the date of your last transaction, or the last wage payment made. This date is entered on line 6.

Employers who cancel their income tax withholding account should, within 30 days after discontinuing business, file a final Nebraska Reconciliation of Income Tax Withheld, Form

Specific Instructions

Line 1. Enter the Nebraska ID number that you hold or have previously held. Do not enter your Social Security number.

Line 2. Enter your federal employer ID number, if you hold one. If one has been applied for, enter “Applied For.” If no federal employer ID number is held or applied for, enter your Social Security number.

Line 3. Enter the Nebraska county where your business is located. If located outside of Nebraska, enter “none”. See line 9 instructions if you are changing your location address.

Name and Address. Enter the name and address as last filed with the Nebraska Department of Revenue (DOR) or which is printed on your present certificate, license, or permit. If you are changing the name or address, the new name or address should be entered in the area immediately following line 9 of this request.

Line 5. Check the tax programs affected by this request. If there is a change in more than one program, check all appropriate boxes.

Line 6. A taxpayer closing a business must request cancellation of the tax program. A taxpayer having a seasonal type of business may request cancellation of the tax program for the period in which no business activity is conducted. Returns must be filed for all periods ending prior to the date of cancellation.

A change in ownership or type of ownership will require a new certificate, license, or permit. When possible, the Nebraska Tax Application, Form 20, used to obtain a new certificate, license, or permit, should accompany or precede this request for cancellation.

Line 7. A taxpayer who previously cancelled a tax program may have it reinstated provided no change in the business has occurred that would require a new certificate, license, or permit.

Line 8. A taxpayer filing a sales tax, use tax, or tire fee return with a tax liability of $900 to $3,000 annually may request a quarterly filing frequency. Those with a tax liability of less than $900 annually may request an annual filing frequency. Taxpayers filing a lodging tax return and remitting $99 or less of tax annually may request to file an annual return. Employers withholding less than $500 annually in state income tax may request to file an annual return, rather than quarterly returns.

Changes in filing frequency are not effective until the taxpayer receives approval from DOR. The taxpayer must complete and file all preidentified returns received for periods prior to the approval.

Line 9. Enter the new name and address. If your new location address is in a different county, enter the county in line 3 for your new location. The location address box cannot contain a PO Box Number; it must show the street address. If the taxpayer wants a return to be mailed to a preparer or another person, the name and mailing address should be completed to show this change.

Line 11. In order to keep your information current, please provide information on changes in officers, members, or partners, of your business or organization. Attach a complete list with the name, street address, email address, title, and Social Security number. Also, identify those that need to be removed and the effective date of the changes.

Line 12. Please provide a detailed explanation of the reason for this request. If there has been a change in ownership, give the name and address of the new owner.

Signature. This request must be signed by the owner, partner, member, corporate officer, or other individual authorized to sign by a power of attorney on file with DOR.

Email. By entering an email address, the taxpayer acknowledges that DOR may contact the taxpayer by email. The taxpayer accepts any risk to confidentiality associated with this method of communication. DOR will send all confidential information by secure email or by the State of Nebraska file share system. If you do not wish to be contacted by email, write “Opt Out” on the line labeled “email address.”

File Information

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The Nebraska 22 form is used to request changes related to business names, addresses, and tax programs. |

| Governing Law | This form is governed by Nebraska Revised Statutes, specifically sections related to taxation and business licensing. |

| Who Must File | Any taxpayer with a name or address change, or those needing to correct or cancel a tax certificate, must file this form. |

| Filing Methods | Taxpayers can submit the form via fax to 402-471-5927 or mail it to the Nebraska Department of Revenue. |

| Related Forms | Form 22A should be used for individual income tax name and address changes, while Form 20 is for new tax applications. |

Other PDF Templates

Ged Nebraska - Ensure you have your GED scores when needed by submitting a transcript request form to the Nebraska Department of Education.

For convenience and clarity in managing your LLC, you can refer to the comprehensive resources available at Texas Documents, which can assist you in filling out the necessary Operating Agreement form tailored to Texas regulations.

Nebraska Sales Tax Form 10 - It's critical to complete the Nebraska Schedule I thoroughly for accurate local tax reporting.

Nebraska Tax Id Number Search - By incorporating a section for accounting preferences, businesses can align their tax reporting with their internal financial management practices.