Nebraska 17 Form

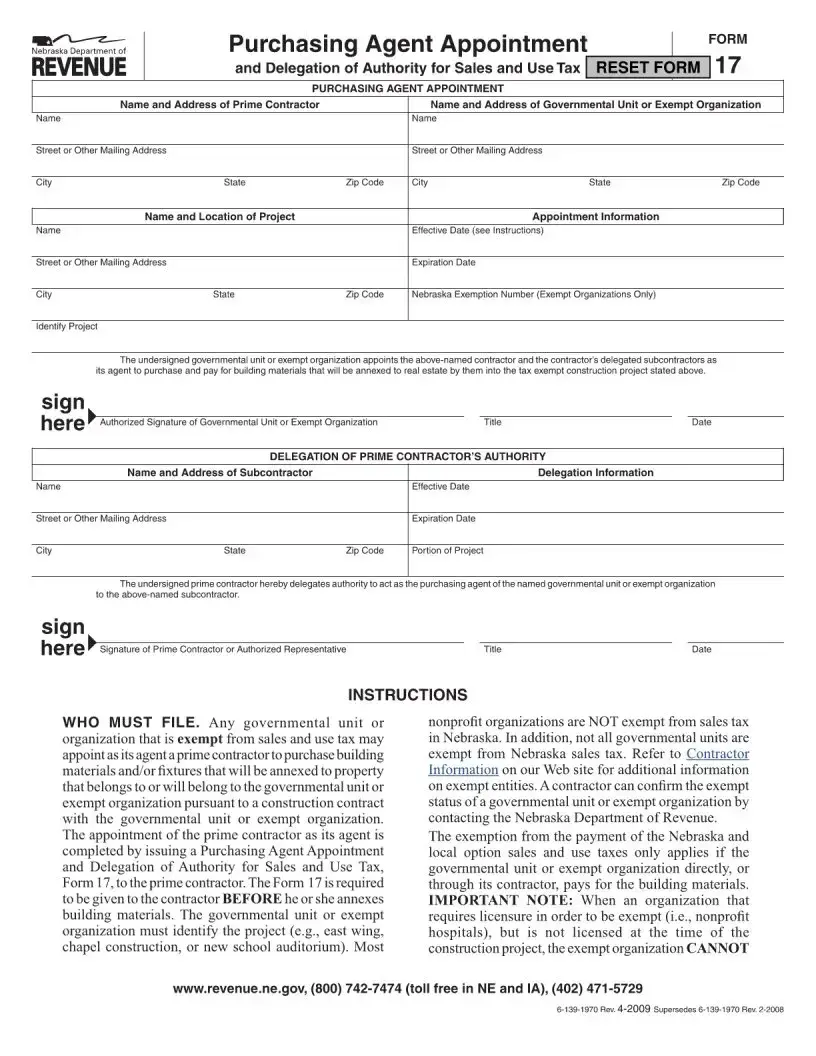

The Nebraska 17 form serves as a critical document for governmental units and exempt organizations in the state, facilitating the appointment of a prime contractor as a purchasing agent for sales and use tax purposes. This form allows the appointed contractor to purchase building materials that will be incorporated into tax-exempt construction projects. It requires essential information such as the names and addresses of both the prime contractor and the governmental unit or exempt organization, as well as details about the specific project. The form also outlines the effective and expiration dates of the appointment, ensuring that the contractor acts within a defined timeframe. Furthermore, the Nebraska 17 form includes a section for the delegation of authority to subcontractors, allowing prime contractors to extend their purchasing capabilities. It is important to note that the form must be completed and provided to the contractor before any materials are annexed to the project, as failure to do so could result in tax liabilities. Additionally, the form emphasizes the necessity for exempt organizations to verify their tax-exempt status, as not all nonprofits qualify for exemption. Proper filing and retention of the form are essential for compliance and for obtaining potential tax refunds if necessary.

Document Preview Example

File Information

| Fact Name | Fact Description |

|---|---|

| Purpose of Form | The Nebraska 17 form is used to appoint a prime contractor as a purchasing agent for a governmental unit or exempt organization to buy building materials for tax-exempt projects. |

| Governing Law | This form is governed by Nebraska state law regarding sales and use tax exemptions for governmental units and exempt organizations. |

| Filing Requirement | A governmental unit or exempt organization must file this form before the prime contractor annexes any building materials to the project. |

| Exemption Criteria | Only certain governmental units and exempt organizations qualify for tax exemption; most nonprofit organizations do not qualify in Nebraska. |

| Delegation of Authority | The prime contractor can delegate purchasing authority to subcontractors, but must complete a separate Form 17 for each delegation. |

| Expiration Dates | Effective and expiration dates must be clearly stated on the form; vague terms like "upon completion" are not acceptable. |

| Retention of Forms | The original Form 17 must be retained by the prime contractor, while the governmental unit or exempt organization should keep a copy. |

| Tax Payment | Tax exemption applies only if the governmental unit or exempt organization directly pays for the building materials, either themselves or through their contractor. |

Other PDF Templates

Nebraska 1040N - Instructions for mailing the completed form vary based on whether a refund is requested, directing to specific department addresses.

To better understand the process and requirements for creating a Power of Attorney, it's advisable to consult resources like Texas Documents, which provide detailed instructions and templates to help you ensure that your legal rights are protected.

Nebraska Sales Tax Permit - The inclusion of a warning about penalties for misuse on Form 13 underscores the commitment to ensuring only rightful exemptions are claimed.