Nebraska 12N Form

The Nebraska 12N form is an essential document for nonresident individuals who have income from certain organizations in Nebraska. This form serves as a Nonresident Income Tax Agreement, allowing individuals to report their share of income derived from estates, trusts, partnerships, S corporations, and limited liability companies. To complete the form, nonresidents must provide their personal information, including names, addresses, and Social Security numbers, along with details about the organization from which they are receiving income. The form requires a declaration that the individual was a nonresident for the specified tax year and outlines the responsibilities of the taxpayer, such as filing a Nebraska Individual Income Tax Return (Form 1040N) and paying any taxes owed. Timeliness is crucial, as the form must be submitted to the organization before it files its own Nebraska income tax return. If not completed correctly, the organization may need to withhold a percentage of the nonresident's income, which can later be credited against their tax liability. Understanding the nuances of the 12N form is vital for nonresidents to ensure compliance and avoid unnecessary tax complications.

Document Preview Example

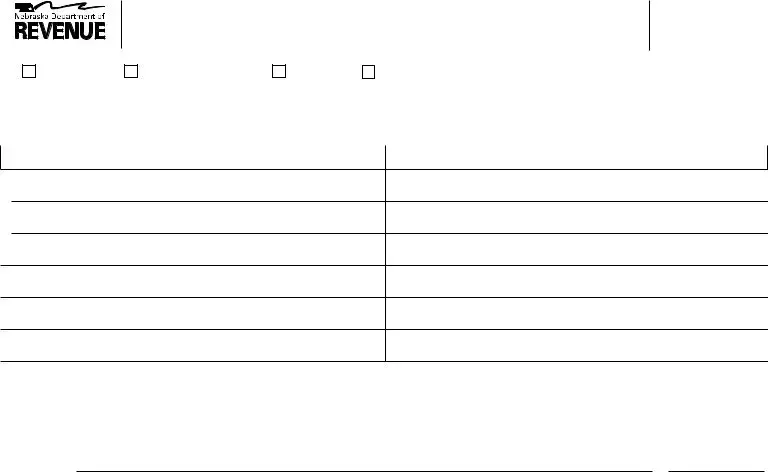

Nebraska Nonresident Income Tax Agreement

FORM 12N

2013

Type of Organization (Check only one.) |

|

|

|

|

|

PLEASE DO NOT WRITE IN THIS SPACE |

||||

Estate or Trust |

Limited Liability Company |

Partnership |

S Corporation |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Taxable Year of Organization |

|

|

|

|

|

|

|

|

|

|

Beginning |

|

|

, 20 |

|

and Ending |

|

, 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident’s Taxable Year Including Organization’s Year End |

|

|

|

|

|

|||||

Beginning |

|

|

, 20 |

|

and Ending |

|

, 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident Individual’s or

Nonresident Grantor’s Name and Mailing Address

Type or Print |

Name |

|

|

|

|

|

|

|

|

Please |

Street or Other Mailing Address |

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code |

Social Security Number |

|

Spouse’s Social Security Number |

||

|

||||

|

|

|

|

|

Internal Revenue Service Center Where Nonresident Individual’s Federal Return is Filed

Organization’s Name and Mailing Address

Name Doing Business As (dba)

Legal Name

Street or Other Mailing Address

City |

|

State |

Zip Code |

Nebraska ID Number |

|

Federal ID Number |

|

|

|

||

|

|

|

|

|

|

|

|

sign here

I declare that I was a nonresident of Nebraska for the tax year shown above, and agree that I will: timely file a Nebraska Individual Income Tax Return, Form 1040N; pay any income tax due; and that I will include in Nebraska adjusted gross income the portion of the

This Agreement shall be binding upon my heirs, representatives, assignees, successors, executors, and administrators.

Signature of Nonresident Beneficiary, Member, Partner, or Shareholder |

Date |

Instructions

Who May File. Any individual taxpayer who was a nonresident of Nebraska during any part of the organization’s taxable year may complete Form 12N. A nonresident individual taxpayer includes a nonresident grantor of a grantor trust.

When and Where to File. A signed and dated Form 12N must be completed each year and delivered to the organization prior to the iling of the organization’s Nebraska income tax return. The due date for the Nebraska income tax return for

estates, trusts, partnerships, and certain limited liability companies (LLCs) is the 15th day of the fourth month following the close of the taxable year. The due date for the Nebraska income tax return of an S corporation and certain LLCs is the 15th

day of the third month following the close of the taxable year.

If Form 12N is Filed. The nonresident individual who has iled the Form 12N is required to timely ile a Nebraska

Individual Income Tax Return, Form 1040N. This return must report tax on the nonresident’s share of the organization’s

Nebraska income attributable to his or her interest in the organization during the taxable year, as well as any other income the nonresident has earned from Nebraska sources.

A nonresident individual taxpayer who has a taxable year different from the taxable year shown on the Form 12N for the estate, trust, S corporation, partnership, or LLC, must report the income on a Form 1040N that includes the tax year end

date of the organization.

If Form 12N is Not Completed and Filed. If Form 12N is not properly completed and attached to the organization’s return for a nonresident individual, the organization is required to remit 6.84% of the nonresident’s share of the organization’s income derived from, or attributable to, Nebraska sources. The income tax withholding must be remitted with the Nebraska Schedule

credit against the individual taxpayer’s Nebraska income tax liability.

If the nonresident has no other Nebraska source income and the organization has iled a Schedule

Attach this agreement to the organization’s Nebraska income tax return.

revenue.nebraska.gov,

File Information

| Fact Name | Description |

|---|---|

| Form Purpose | The Nebraska 12N form is used by nonresident individuals to report their share of income from organizations operating in Nebraska. |

| Filing Requirement | Nonresidents must file Form 12N each year before the organization submits its Nebraska income tax return. |

| Taxation Rate | If Form 12N is not filed, the organization must withhold 6.84% of the nonresident's share of income attributable to Nebraska sources. |

| Governing Law | This form is governed by Nebraska Revised Statute § 77-2724, which outlines the tax obligations for nonresidents. |

Other PDF Templates

Nys Notary Practice Exam Pdf - Understand the prohibition and legal consequences of misusing the term “Notario Publico” in Nebraska to maintain professional credibility.

To ensure a well-structured foundation for your business, it's crucial to have a solid understanding of the Texas Operating Agreement form, which details your LLC's governance. For a comprehensive resource to guide you through this process, visit Texas Documents.

Notary Price - A condition for notarial commission in Nebraska, involving a monetary bond and a serious pledge of allegiance and duty.