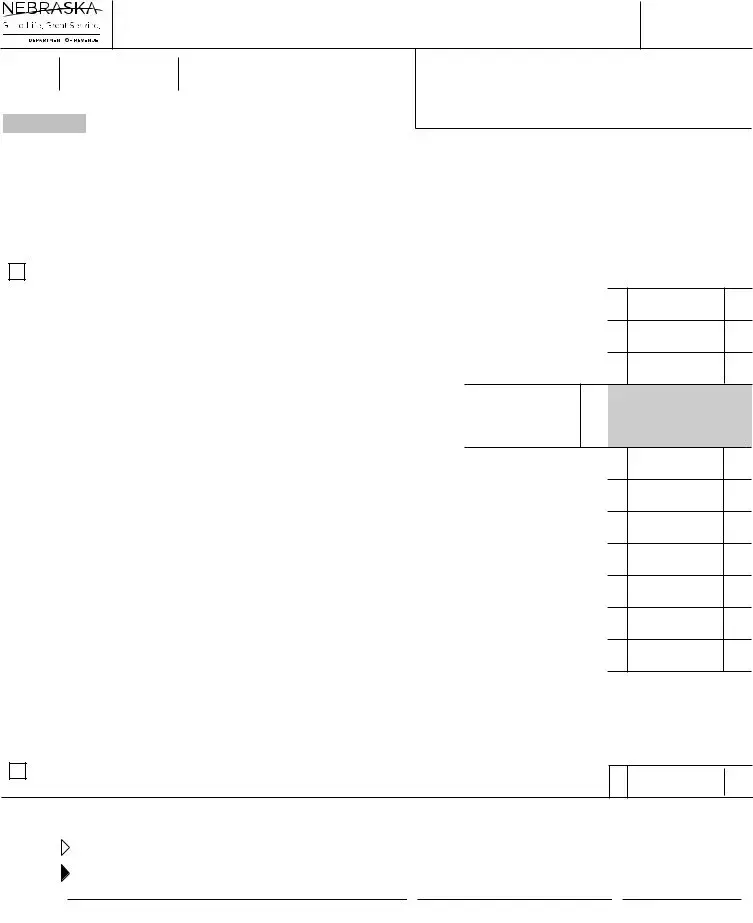

Nebraska 10 Form

The Nebraska 10 form, officially known as the Nebraska and Local Sales and Use Tax Return, serves as a crucial document for businesses operating within the state. Designed to facilitate the reporting and payment of sales and use taxes, this form requires businesses to detail their gross sales and services conducted in Nebraska. It encompasses various sections, including a breakdown of net taxable sales, state and local sales tax calculations, and necessary schedules that provide further details on local tax rates. Additionally, the form addresses changes in business status, allowing for the cancellation of permits under specific circumstances, such as business closure or transfer of ownership. The Nebraska 10 form also incorporates a collection fee for sales tax, ensuring that businesses are compensated for their role in tax collection. Furthermore, it outlines the due dates for submission and payment, emphasizing the importance of timely compliance to avoid penalties. For those utilizing multivendor marketplace platforms, specific sections cater to their unique reporting needs, ensuring accurate tax calculations. Overall, the Nebraska 10 form is a comprehensive tool that streamlines the tax reporting process for businesses, contributing to the state’s revenue system while promoting transparency and accountability.

Document Preview Example

Nebraska and Local Sales and Use Tax Return

•If applicable, complete Schedule I on reverse side.

•See Nebraska Net Taxable Sales and Use Tax Worksheets.

FORM

10

Tax Category

Nebraska ID Number

Rpt.Code |

Tax Period |

Please Do Not Write In This Space

Due Date:

Name and Location Address |

Name and Mailing Address |

• Name, address, or ownership changes? See instructions.

Check this box if your business has permanently closed, has been sold to someone else, or your permit is no longer needed. New owners must apply for their own sales tax permit.

1 |

Gross sales and services in Nebraska (see instructions and worksheets) |

|

1 |

|

2 |

Net Nebraska taxable sales as shown on line 2, Form 10 Worksheets (see instructions) |

2 |

||

3 |

Nebraska sales tax (line 2 multiplied by .055) |

|

3 |

|

|

Nebraska use tax (see instructions) |

|

|

|

4 |

4 |

|

|

|

|

Complete Nebraska Schedule I prior to completing lines 5 & 6. |

|

|

|

5 |

Local use tax from Nebraska Schedule I |

5 |

|

|

|

|

|

|

|

6 |

Local sales tax from Nebraska Schedule I |

|

6 |

|

|

Total Nebraska and local sales tax (line 3 plus line 6) |

|

|

|

7 |

|

7 |

||

8 |

Sales tax collection fee (line 7 multiplied by .025; if the result is $75.00 or more, enter $75.00) |

8 |

||

9 |

Sales tax due (line 7 minus line 8) |

|

9 |

|

10 |

Total Nebraska and local use tax (line 4 plus line 5) |

|

10 |

|

11 |

Total Nebraska and local sales and use tax due (line 9 plus line 10) |

|

11 |

|

12 |

Previous balance with applicable interest at |

|

|

|

|

% per year and payments received through |

|

|

12 |

|

|

|

|

|

00

00

Check this box if your payment is being made electronically.

13 Balance due (line 11 plus or minus line 12). Pay in full with return .....................................................

13

sign here

paid preparer’s use only

Under penalties of law, I declare that as taxpayer or preparer I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is correct and complete.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Signature |

|

Title |

|

Daytime Phone |

|

Date |

|

Email Address |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Preparer’s Signature |

|

Date |

|

Preparer’s PTIN |

|

|

|

|

|

|

|

|

|

|

Print Firm’s Name (or yours if |

EIN |

Daytime Phone |

For tax assistance, call

This return is due on or before the 20th day of the month following the tax period indicated above.

Use NebFile to electronically file and pay your taxes.

Paper filers mail this return and payment to: Nebraska Department of Revenue, PO Box 98923, Lincoln, NE

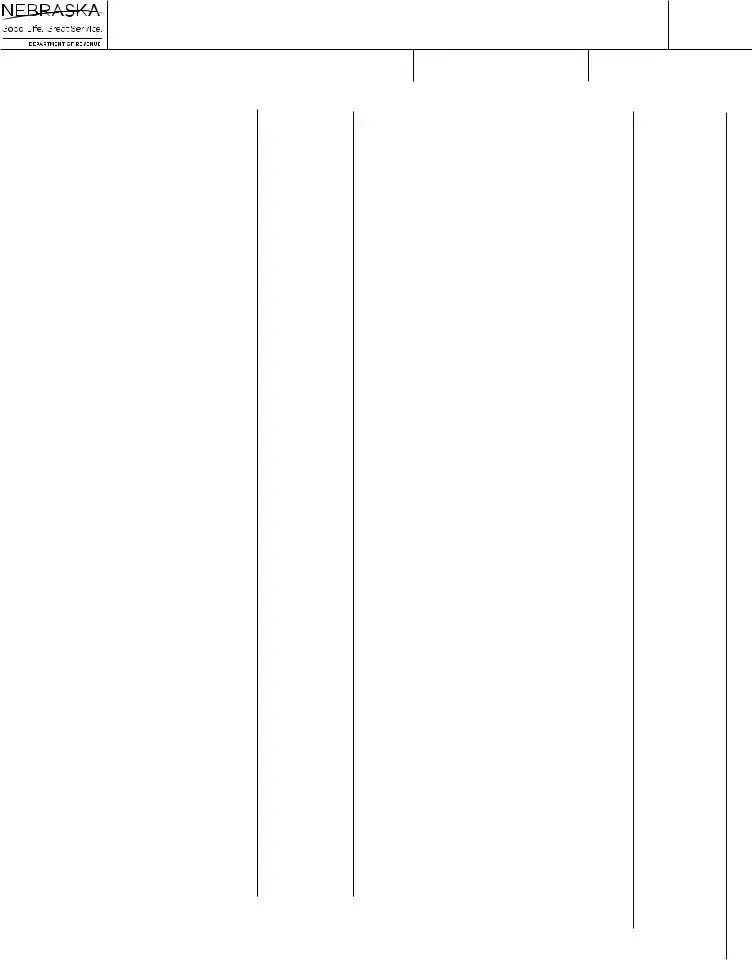

Nebraska Schedule I — Local Sales and Use Tax

•Attach to Form 10.

•If applicable, complete the “Multivendor Marketplace Platform (MMP) Users Only” section on Page 3.

•MVL, ATV, UTV, and Motorboat Leases or Rentals is on Page 3.

FORM 10

Schedule I Page 1 of 3

Name on Form 10

Nebraska ID Number

Tax Period

|

|

|

Column A |

Column B |

|

|

|

|

Column A |

|

Column B |

City |

Code |

Rate |

Use Tax |

Sales Tax |

City |

Code |

Rate |

Use Tax |

|

Sales Tax |

|

Ainsworth |

.015 |

|

|

Clay Center |

.015 |

|

|

|

|||

Albion |

.015 |

|

|

Clearwater |

.015 |

|

|

|

|||

Alliance |

.015 |

|

|

Coleridge |

.01 |

|

|

|

|

||

Alma |

.02 |

|

|

Columbus |

.015 |

|

|

|

|||

Ansley |

.01 |

|

|

Cordova |

.01 |

|

|

|

|

||

Arapahoe |

.01 |

|

|

Cortland** |

.01 |

|

|

|

|

||

Arcadia |

.01 |

|

|

Cozad |

.015 |

|

|

|

|||

Arlington |

.015 |

|

|

Crawford |

.015 |

|

|

|

|||

Arnold |

.01 |

|

|

Creighton |

.01 |

|

|

|

|

||

Ashland |

.015 |

|

|

Crete |

.02 |

|

|

|

|

||

Atkinson |

.015 |

|

|

Crofton |

.01 |

|

|

|

|

||

Auburn |

.01 |

|

|

Curtis |

.01 |

|

|

|

|

||

Bancroft |

.015 |

|

|

Dakota City |

.01 |

|

|

|

|

||

Bassett |

.015 |

|

|

Dannebrog |

.01 |

|

|

|

|

||

Battle Creek |

.015 |

|

|

Davey |

.015 |

|

|

|

|||

Bayard |

.01 |

|

|

David City |

.02 |

|

|

|

|

||

Beatrice** |

.02 |

|

|

Daykin |

.01 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Beaver City |

.01 |

|

|

Decatur |

.02 |

|

|

|

|

||

Beaver Crossing |

.01 |

|

|

Deshler |

.01 |

|

|

|

|

||

Beemer |

.015 |

|

|

DeWeese |

.01 |

|

|

|

|

||

Bellevue |

.015 |

|

|

DeWitt |

.01 |

|

|

|

|

||

Bellwood |

.015 |

|

|

Diller |

.01 |

|

|

|

|

||

Benedict |

.015 |

|

|

Dodge |

.015 |

|

|

|

|||

Benkelman |

.015 |

|

|

Doniphan |

.01 |

|

|

|

|

||

Bennet |

.01 |

|

|

Dorchester |

.015 |

|

|

|

|||

Bennington |

.015 |

|

|

City of Douglas |

.015 |

|

|

|

|||

Bertrand |

.015 |

|

|

Duncan |

.015 |

|

|

|

|||

Big Springs |

.01 |

|

|

Eagle |

.01 |

|

|

|

|

||

Blair |

.015 |

|

|

Edgar |

.01 |

|

|

|

|

||

Bloomfield |

.01 |

|

|

Edison |

.01 |

|

|

|

|

||

Blue Hill |

.015 |

|

|

Elgin |

.01 |

|

|

|

|

||

Brainard |

.01 |

|

|

Elm Creek |

.01 |

|

|

|

|

||

Bridgeport |

.01 |

|

|

Elmwood |

.015 |

|

|

|

|||

Broken Bow |

.015 |

|

|

Elwood |

.01 |

|

|

|

|

||

Brownville |

.01 |

|

|

Eustis |

.01 |

|

|

|

|

||

Burwell |

.015 |

|

|

Ewing |

.005 |

|

|

|

|||

Cairo |

.01 |

|

|

Exeter |

.015 |

|

|

|

|||

Callaway |

.01 |

|

|

Fairbury |

.02 |

|

|

|

|

||

Cambridge |

.02 |

|

|

Fairfield |

.015 |

|

|

|

|||

Cedar Rapids |

.01 |

|

|

Falls City |

.015 |

|

|

|

|||

Central City |

.015 |

|

|

Farnam |

.01 |

|

|

|

|

||

Ceresco |

.015 |

|

|

Fordyce |

.01 |

|

|

|

|

||

Chadron |

.02 |

|

|

Fort Calhoun |

.015 |

|

|

|

|||

Chambers |

.01 |

|

|

Franklin |

.01 |

|

|

|

|

||

Chappell |

.02 |

|

|

Fremont |

.015 |

|

|

|

|||

Chester |

.01 |

|

|

Friend |

.015 |

|

|

|

|||

Clarks |

.015 |

|

|

Fullerton |

.02 |

|

|

|

|

||

Clarkson |

.015 |

|

|

Geneva |

.02 |

|

|

|

|

||

Clatonia** |

.005 |

|

|

Genoa |

.015 |

|

|

|

|||

1 Total the amounts of use tax in Column A (enter here and on line 6, Column A, on Page 3) |

1 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

2 Total the amounts of sales tax in Column B (enter here and on line 6, Column B, on Page 3) |

2 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Complete Pages 2 and 3 of this Schedule I. |

|

|

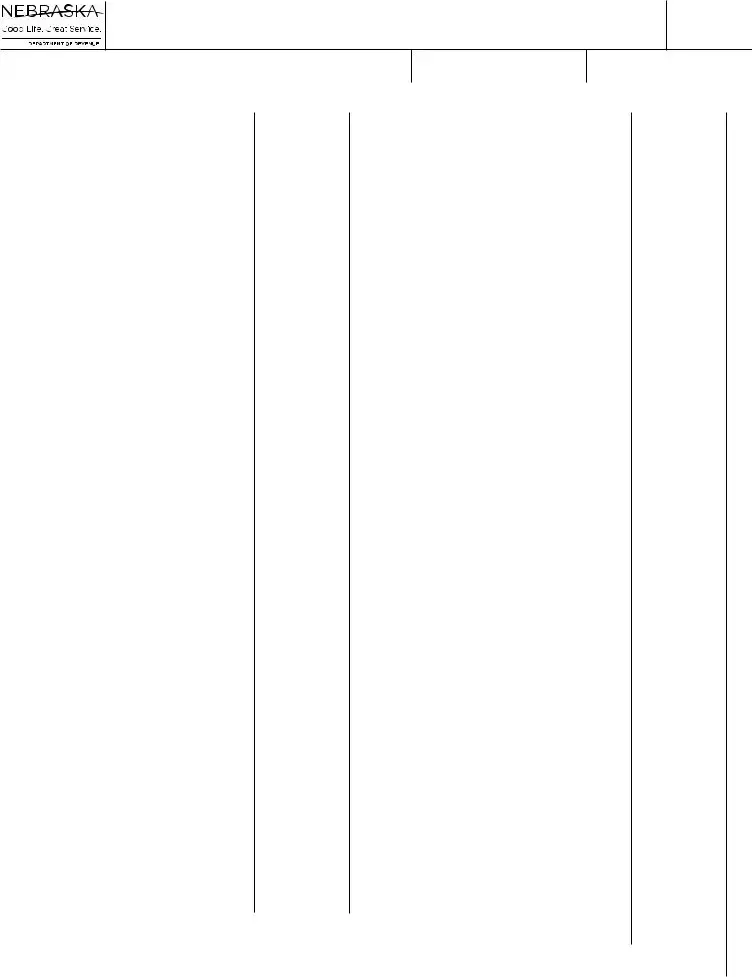

Nebraska Schedule I — Local Sales and Use Tax

FORM 10

Schedule I Page 2 of 3

Name on Form 10

Nebraska ID Number

Tax Period

|

|

|

Column A |

Column B |

|

|

|

|

Column A |

|

Column B |

City |

Code |

Rate |

Use Tax |

Sales Tax |

City |

Code |

Rate |

Use Tax |

|

Sales Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gering |

.015 |

|

|

Maywood |

.015 |

|

|

|

|||

Gibbon |

.015 |

|

|

McCook |

.015 |

|

|

|

|||

Gordon |

.015 |

|

|

McCool Junction |

.015 |

|

|

|

|||

Gothenburg |

.015 |

|

|

Meadow Grove |

.015 |

|

|

|

|||

Grand Island |

.02 |

|

|

Milford |

.01 |

|

|

|

|

||

Grant |

.01 |

|

|

Milligan |

.015 |

|

|

|

|||

Greeley |

.015 |

|

|

Minden |

.02 |

|

|

|

|

||

Greenwood |

.01 |

|

|

Mitchell |

.015 |

|

|

|

|||

Gresham |

.015 |

|

|

Monroe |

.015 |

|

|

|

|||

Gretna |

.02 |

|

|

Morrill |

.01 |

|

|

|

|

||

Guide Rock |

.015 |

|

|

Mullen |

.01 |

|

|

|

|

||

Harrison |

.015 |

|

|

Murray |

.01 |

|

|

|

|

||

Hartington |

.015 |

|

|

Nebraska City |

.02 |

|

|

|

|

||

Harvard |

.01 |

|

|

Nehawka |

.01 |

|

|

|

|

||

Hastings |

.015 |

|

|

Neligh |

.01 |

|

|

|

|

||

Hay Springs |

.01 |

|

|

Nelson |

.01 |

|

|

|

|

||

Hebron |

.015 |

|

|

Newman Grove |

.015 |

|

|

|

|||

Hemingford |

.015 |

|

|

Niobrara |

.01 |

|

|

|

|

||

Henderson |

.015 |

|

|

Norfolk |

.015 |

|

|

|

|||

Hickman |

.015 |

|

|

North Bend |

.015 |

|

|

|

|||

Hildreth |

.01 |

|

|

North Platte |

.015 |

|

|

|

|||

Holdrege |

.015 |

|

|

Oakland |

.015 |

|

|

|

|||

Hooper |

.01 |

|

|

Oconto |

.01 |

|

|

|

|

||

Howells |

.015 |

|

|

Odell** |

.01 |

|

|

|

|

||

Hubbard |

.015 |

|

|

Ogallala |

.015 |

|

|

|

|||

Hubbell |

.01 |

|

|

Omaha |

.015 |

|

|

|

|||

Humphrey |

.02 |

|

|

O’Neill |

.015 |

|

|

|

|||

Hyannis |

.01 |

|

|

Orchard |

.015 |

|

|

|

|||

Imperial |

.01 |

|

|

Ord |

.02 |

|

|

|

|

||

Jackson |

.015 |

|

|

Osceola |

.015 |

|

|

|

|||

Jansen |

.01 |

|

|

Oshkosh |

.02 |

|

|

|

|

||

Juniata |

.015 |

|

|

Osmond |

.015 |

|

|

|

|||

Kearney |

.015 |

|

|

Oxford |

.015 |

|

|

|

|||

Kimball |

.015 |

|

|

Palmer |

.015 |

|

|

|

|||

Laurel |

.01 |

|

|

Palmyra |

.01 |

|

|

|

|

||

LaVista |

.02 |

|

|

Papillion |

.02 |

|

|

|

|

||

Lawrence |

.01 |

|

|

Pawnee City |

.02 |

|

|

|

|

||

Leigh |

.015 |

|

|

Paxton |

.02 |

|

|

|

|

||

Lewellen |

.01 |

|

|

Pender |

.015 |

|

|

|

|||

Lexington |

.015 |

|

|

Peru |

.01 |

|

|

|

|

||

Lincoln |

.0175 |

|

|

Petersburg |

.01 |

|

|

|

|

||

Linwood |

.01 |

|

|

Pierce |

.01 |

|

|

|

|

||

Loomis |

.01 |

|

|

Pilger |

.015 |

|

|

|

|||

Louisville |

.015 |

|

|

Plainview |

.015 |

|

|

|

|||

Loup City |

.02 |

|

|

Platte Center |

.015 |

|

|

|

|||

Lyons |

.015 |

|

|

Plattsmouth |

.015 |

|

|

|

|||

Madison |

.015 |

|

|

Pleasanton |

.01 |

|

|

|

|

||

Malcolm |

.01 |

|

|

Plymouth |

.015 |

|

|

|

|||

Manley |

.005 |

|

|

Ponca |

.015 |

|

|

|

|||

Marquette |

.015 |

|

|

Ralston |

.015 |

|

|

|

|||

3 Total the amounts of use tax in Column A (enter here and on line 7, on page 3) |

3 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||

4 Total the amounts of sales tax in Column B (enter here and on line 7, on page 3) |

4 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska Schedule I — Local Sales and Use Tax

FORM 10

Schedule I Page 3 of 3

Name on Form 10

Nebraska ID Number

Tax Period

|

|

|

Column A |

Column B |

|

|

|

|

|

Column A |

|

Column B |

City |

Code |

Rate |

Use Tax |

Sales Tax |

City |

Code |

Rate |

Use Tax |

|

Sales Tax |

||

Randolph |

.015 |

|

|

Upland |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Ravenna |

.015 |

|

|

Utica |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Red Cloud |

.015 |

|

|

Valentine |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Republican City |

.01 |

|

|

Valley |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Rising City |

.01 |

|

|

Verdigre |

.015 |

|

|

|

||||

Roca |

.015 |

|

|

Wahoo |

.02 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Rushville |

.015 |

|

|

Wakefield |

.01 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

St. Edward |

.015 |

|

|

Waterloo |

.02 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

St. Paul |

.01 |

|

|

Wauneta |

.01 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Sargent |

.02 |

|

|

Wausa |

.01 |

|

|

|

|

|||

Schuyler |

.015 |

|

|

Waverly |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Scottsbluff |

.015 |

|

|

Wayne |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Scribner |

.015 |

|

|

Weeping Water |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Seward |

.015 |

|

|

West Point |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Shelby |

.015 |

|

|

Wilber |

.015 |

|

|

|

||||

Sidney |

.02 |

|

|

Wisner |

.02 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Silver Creek |

.01 |

|

|

Wood River |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

S. Sioux City |

.015 |

|

|

Wymore** |

.015 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spalding |

.015 |

|

|

York |

.02 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spencer |

.01 |

|

|

|

|

|

|

|

|

|

|

|

Springfield |

.015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Springview |

.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stanton |

.015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sterling |

.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stromsburg |

.015 |

|

|

|

|

|

|

|

|

|

|

|

Stuart |

.015 |

|

|

|

|

|

|

|

Column A |

|

Column B |

|

Superior |

.015 |

|

|

County |

Code |

Rate |

Use Tax |

|

Sales Tax |

|||

Sutton |

.015 |

|

|

Dakota County* |

.005 |

|

|

|

|

|||

Syracuse |

.01 |

|

|

Gage County** |

.005 |

|

|

|

|

|||

Tecumseh |

.015 |

|

|

**Dakota County tax is only collected |

|

|

|

|

||||

Tekamah |

.02 |

|

|

in areas outside of any city in Dakota |

|

|

|

|

||||

|

|

County that imposes a city sales and |

|

|

|

|

||||||

Terrytown |

.01 |

|

|

use tax. |

|

|

|

|

|

|

|

|

|

|

**Gage County tax is collected in the entire |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||

Tilden |

.015 |

|

|

|

|

|

||||||

|

|

Gage County, including in any city in |

|

|

|

|

||||||

Uehling |

.01 |

|

|

Gage County that imposes a city sales |

|

|

|

|

||||

|

|

and use tax. It is added to the state and |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||

Unadilla |

.015 |

|

|

|

|

|

||||||

|

|

any applicable city tax. |

|

|

|

|

|

|

||||

5 Total the amounts of use tax in Column A and sales tax in Column B on this page |

|

5 |

|

|

|

|||||||

6 Enter the total amounts from Column A and Column B (lines 1 and 2) from Page 1 |

|

6 |

|

|

|

|||||||

7 Enter the total amounts from Column A and Column B (lines 3 and 4) from Page 2 |

|

7 |

|

|

|

|||||||

8 Total use tax to report (Column A, total of lines 5, 6, and 7). Enter here and on line 5, Form 10 |

|

8 |

|

|

|

|||||||

9 Total sales tax to report (Column B, total of lines 5, 6, and 7). Enter here and on line 6, Form 10 |

9 |

|

||||||||||

Multivendor Marketplace Platform (MMP) Users Only

Retailers, including remote retailers – Enter the total dollar amount of your Nebraska sales made by MMPs collecting sales tax on your behalf. Subtract this amount from your total gross sales in Nebraska reported on line 1, Form 10, to determine your net Nebraska taxable sales (see Form 10 instructions)(Code

MVL, ATV, UTV, and Motorboat Leases or Rentals

To be completed by retailers who are leasing (1) motor vehicles to others for periods of more than 31 days;

(2)ATVs or UTVs; or (3) motorboats or motorized personal watercraft.

1 Enter the amount of state sales tax included on Form 10, line 3, that was reported on

leases (more than 31 days) of motor vehicles (see instructions) |

(Code |

2Enter the amount of state sales tax included on Form 10, line 3, that was reported on all leases or

rentals of |

(Code |

3Enter the amount of state sales tax included on Form 10, line 3, that was reported on all leases or

rentals of motorboats and motorized personal watercraft (see instructions) |

(Code |

Nebraska Net Taxable Sales and Use Tax Worksheets

•The online version of these worksheets expands for detailed information.

•To see this information, complete these worksheets online.

•Keep a copy of these worksheets.

Form 10

Worksheets

Nebraska Net Taxable Sales Worksheet

1.Gross Sales and Services in Nebraska Regulation

Allowable Exemptions and Deductions from Gross Sales

A.Sales of nontaxable services. See taxable services in Regulation

B.Sales of items or taxable services sold for resale. Regulation

C.Sales to exempt purchasers. Regulation

D.Sales of exempt items or services. Regulation

E.Exempt sellers. Regulation

F.

G.Other allowable deductions (see our website for a list of allowable deductions and the applicable regulations). Retailers using a Multivendor Marketplace Platform (MMP) must include the total dollar amount of your Nebraska sales made by MMPs collecting and remitting sales tax on your behalf..........................................................................................

H.Total allowable exemptions and deductions (A through G) ...................................................

2.Net Nebraska Taxable Sales (line 1 minus line H). Enter on line 2, Form 10 ..................

Nebraska Use Tax Worksheet

1.Cost of items and taxable services purchased for use in Nebraska on which

tax was not paid. Regulation

2.Cost of items withdrawn from inventory for personal or business use. Regulation

3.Total amount subject to Nebraska use tax (line 1 plus line 2) .........................................................

4.Nebraska use tax (line 3 multiplied by the rate identified on line 3, Form 10).................................

5.Credit for tax paid to other states on items in line 4. Regulation

6.Nebraska Use Tax Due (line 4 minus line 5). Enter on line 4, Form 10 ...........................................

Instructions for Form 10

Who Must File. Every retailer must file a Form 10. Retailers include remote sellers and Multivendor Marketplace Platforms (MMPs) with more than $100,000 of gross sales or 200 or more transactions in Nebraska. All retailers must hold a Nebraska Sales Tax Permit.

How to Obtain a Permit. You must complete a Nebraska Tax Application, Form 20, to apply for a sales tax permit. After the application has been processed, you will receive your Nebraska sales tax ID number printed on the permit.

When and Where to File. This return and payment are due the 20th of the month following the tax period covered by the return. Paper returns must be mailed to the Nebraska Department of Revenue, PO Box 98923, Lincoln, NE

Electronic Filing |

Form 10 |

using NebFile |

for Business. Retailers approved to file a combined |

return |

or required to |

pay electronically, must

Preidentified Return. Retailers will be mailed a preidentified paper return if they did not

Name and Address Changes. If the business name has changed and it is a name change only (for example, if the ownership or federal ID number has not changed), mark through the previous name and plainly print the new name and write “name change only.” If you

If there is a change or correction in the name or address, mark through the incorrect information and plainly print the correct information. If this is the result of a relocation of your business, indicate this by writing “relocated” next to the change made. If you are

Ownership Changes. A change in ownership, or type of ownership (individual to a partnership, partnership to a corporation, etc.) requires you to cancel your permit and obtain a new permit for the new business. To cancel the old permit, check the box in the upper left corner of the Form 10. The new owners must complete a Form 20 to obtain their own sales tax permit. The new owners of the business should not use the previous owner’s preidentified sales and use tax return.

Credit Returns. If line 11 is a credit amount, documentation must be sent with the return to support the credit. This documentation must include a letter of explanation, invoices, or credit memos issued to customers. When

Amended Returns. An amended Form 10, available on DOR’s website, may only be filed by paper. Mandated retailers must pay all balance dues electronically. If you

Penalty and Interest. If a return is not filed and/or is not paid by the due date, a penalty may be assessed in the amount of 10% of the tax due or $25, whichever is greater. Interest on the unpaid tax will be assessed at the rate printed on line 12 from the due date until payment is received.

Retention of Records. Records to substantiate this return must be kept and be available to DOR for a period of at least three years following the date of filing the return.

Additional information regarding sales and use taxes may be found in the “Information Guides” section of DOR’s website.

Specific Instructions

Retailers must report the tax due for each type of tax. If no sales or use tax is due, the retailer must indicate it by entering a zero, N/A, drawing a line, writing a word, or statement on the appropriate line. Failure to do so extends the statute of limitations to six years for audit purposes.

Complete the Nebraska Net Taxable Sales and Use Tax Worksheets to assist with the Form 10.

Line 1. Enter the total dollar amount of ALL Nebraska sales, leases, rentals, and services made or facilitated by your business or by an MMP on your behalf. Enter both taxable and exempt sales. Line 1 does not include the amount of sales tax collected.

Line 2. Complete the Nebraska Net Taxable Sales and Use Tax Worksheets for allowable exemptions or deductions, including the MMP deduction. Enter the Nebraska net taxable sales rounded to the nearest whole dollar. Retailers making sales through MMPs refer to the MMP Users Only instructions below.

Lines 4 and 5. Transactions Subject to Use Tax. Use tax is due on all taxable purchases when Nebraska and any applicable local sales tax is not paid. Use tax is due on your cost of these items or taxable services. Examples include, but are not limited to:

Purchases of uniforms, magazines, computers, software; or

Purchases of taxable services such as repair or installation labor on tangible personal property, pest control, building cleaning, or motor vehicle towing;

Purchases of property from outside Nebraska, brought to Nebraska for use or storage; and

Items withdrawn from inventory for use or donation. Line 6. Enter the total local sales tax from the Schedule I.

Line 8. The retailer is allowed to retain a fee for collecting the Nebraska and local sales tax.

Line 12. A balance due resulting from a partial payment, mathematical or clerical errors, penalty, or interest relating to prior returns is entered on this line. The amount of interest includes interest on unpaid tax through the due date of this return. If the amount due is paid before the due date, interest will be recomputed and a credit will be on your next return. If you have already paid the amount on this line with a previous remittance, please disregard it.

Acredit is indicated by the word “subtract” and can be subtracted from the amount due on line 11. However, if your records do not support this credit, please contact DOR.

Line 13. All taxpayers are encouraged to make payments electronically. Do not send a paper check if you are mandated to pay electronically. Electronic payments may be made using DOR’s free

Signatures. This return must be signed by the taxpayer, partner, officer, or member. Include a daytime phone number and email address in case DOR needs to contact you about your account.

Email. By entering an email address, the taxpayer acknowledges that DOR may contact the taxpayer by email. The taxpayer accepts any risk to confidentiality associated with this method of communication. DOR will send all confidential information by secure mail or the State of Nebraska’s file share system. If you do not wish to be contacted by email, write “Opt Out” on the line labeled “email address.”

If the taxpayer authorizes another person to sign this return, there must be a

power of attorney on file with DOR. Any person who is |

paid for |

preparing a |

taxpayer’s return must also sign the return as preparer. |

are required |

to identify the person completing the return during the filing process.

Nebraska Schedule I

The Schedule I displays any city or county that has been reported in the last 12 months. Enter the local sales and use tax due for each city and county. Retailers that make sales using an MMP should enter the result of the total city or county sales tax due by the retailer and the MMP less the city or county sales tax remitted by the MMP on the retailer’s behalf. A city or county may be added by writing the information in the blank boxes on Schedule I. You can find listings of the city and county taxing jurisdictions and the sales tax rates on DOR’s website.

Line 1, Local Use Tax. Total the amounts reported in the use tax column and enter the total from Nebraska Schedule I, on line 5, Form 10.

Line 2, Local Sales Tax. Total the amounts reported in the sales tax column and enter the total from Nebraska Schedule I, on line 6, Form 10.

Multivendor Marketplace Platform (MMP) Users Only

Retailers making sales into Nebraska using an MMP must enter the dollar amount of Nebraska sales remitted by MMPs that are collecting Nebraska sales tax on your behalf. Retain documentation from your MMPs that substantiates this amount.

MVL, ATV, UTV, and Motorboat Leases or Rentals

Enter the portion of the state sales tax (reported on Form 10, line 3) that is from all leases or rentals of: (1) automobiles, trucks, trailers, semitrailers, and truck tractors for periods of more than 31 days that are not classified as transportation equipment, see the Nebraska Sales Tax on Leased Motor Vehicles Information Guide; (2)

File Information

| Fact Name | Description |

|---|---|

| Purpose of Form | The Nebraska 10 form is used to report and pay sales and use taxes collected by businesses operating in Nebraska. |

| Governing Laws | This form is governed by Nebraska Revised Statutes, particularly sections related to sales and use tax regulations. |

| Filing Deadline | Taxpayers must submit the form by the 20th day of the month following the end of the tax period. |

| Cancellation Options | Businesses can check a box to cancel their permit if they have closed, are seasonal, or have sold their business. |

| Tax Calculation | Line 3 calculates Nebraska sales tax by multiplying net taxable sales by the tax rate of 5.5%. |

Other PDF Templates

Nebraska State Tax Form - A document facilitating the smooth transition of Nebraska business details within state tax administration systems.

When preparing to grant someone the authority to act on your behalf, it's important to familiarize yourself with the requirements of the Texas Power of Attorney form. You can find a detailed guide on how to fill it out effectively through resources like Texas Documents, ensuring that your decisions and preferences are duly honored.

Nebraska Medicaid Enrollment - Providers need to disclose if any owner or controlling interest holder has a stake in other entities participating in Medicaid or other health programs.