Mltc 62 Nebraska Form

The MLTC 62 Nebraska form is a crucial document designed for entities participating in Medicaid, particularly in the context of long-term care services. This form is mandated by the Centers for Medicare and Medicaid Services and requires detailed disclosures about ownership and controlling interests, as well as any relevant criminal convictions. Providers must complete this form at the time of enrollment or contracting, during surveys, or within 35 days of a written request from the Nebraska Department of Health and Human Services. It gathers essential identifying information about the entity, including its legal name, provider number, and contact details. The form also requires the disclosure of individuals with a significant ownership or control interest—defined as owning 5% or more—along with their relationships to one another, if applicable. Additionally, it seeks information about managing employees and any connections to other Nebraska Medicaid providers. Importantly, the form includes a section for reporting any criminal convictions related to Medicaid involvement, ensuring transparency and accountability within the healthcare system. Completing the MLTC 62 accurately is not just a regulatory requirement; it also helps maintain the integrity of the services provided to vulnerable populations in Nebraska.

Document Preview Example

Department of Health & Human Services

N E B R A S K A

Nebraska Department of Health and Human Services

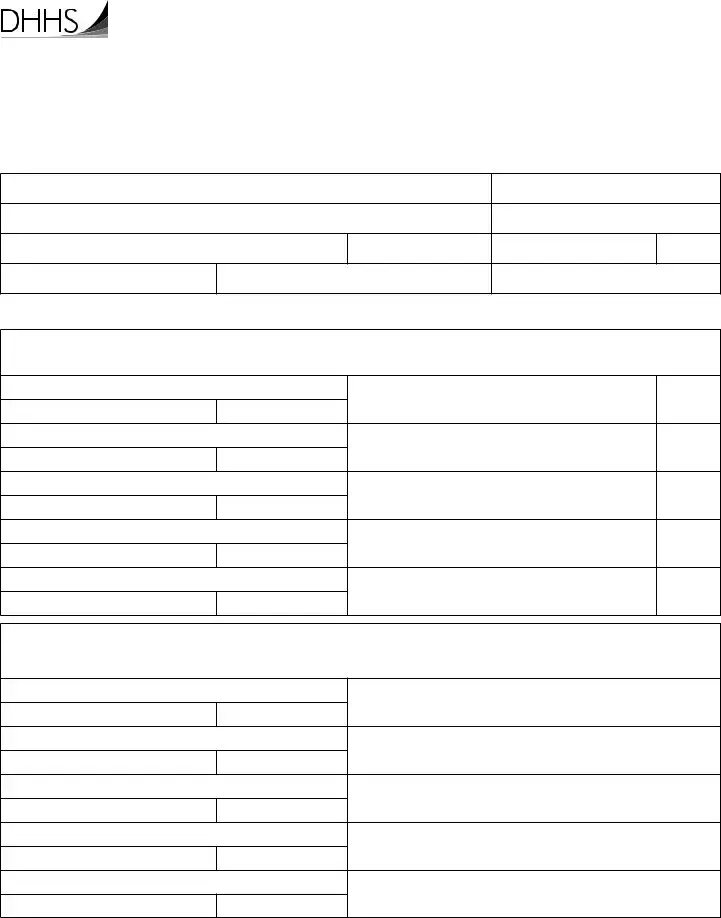

NEBRASKA OWNERSHIP/CONTROLLING INTEREST AND CONVICTION DISCLOSURE

Completion of this form is required as mandated by the Centers for Medicare and Medicaid Services, Department of Health and Human Services and applicable regulations as found at 42 CFR 455.100 through 42. CFR 455.106. Disclosure must be made at the time of enrollment or contracting with the Department, at the time of survey, or within 35 days of a written request from the Department. It is the provider’s responsibility to ensure all information is accurate and to report any changes as required by law by completing a new Ownership and Disclosure form.

IDENTIFYING INFORMATION

Name of Entity: (Legal name as it appears on tax identiication form) |

|

Provider Number (If currently enrolled in NE Medicaid): |

||

Doing Business As: |

|

|

NPI Number |

|

Street Address: |

|

City: |

State: |

Zip Code: |

Telephone Number: |

Fax Number: |

|

|

|

IF GOVERNMENT ENTITY OR

A. List the name, address, Federal Employer Identiication Number (FEIN) or Social Security Number (SSN) and Date of Birth (DOB) of each person with an ownership or control interest in the disclosing entity or in any subcontractor in which the disclosing entity has direct or indirect ownership of 5% or more. If more space is needed attach a separate list including the required information.

Name

SSN/FTIN

Name

SSN/FTIN

Name

SSN/FTIN

Name

SSN/FTIN

Name

SSN/FTIN

Address

DOB

Address

DOB

Address

DOB

Address

DOB

Address

DOB

%Interest

%Interest

%Interest

%Interest

%Interest

B. Are any of the above mentioned persons related to one another as a spouse, parent, child, or sibling? If more space is needed

attach a separate list including the required information.

Yes No If yes, please name and show relationship.

Name

SSN

Name

SSN

Name

SSN

Name

SSN

Name

SSN

Relationship

DOB

Relationship

DOB

Relationship

DOB

Relationship

DOB

Relationship

DOB

PAGE 1/3

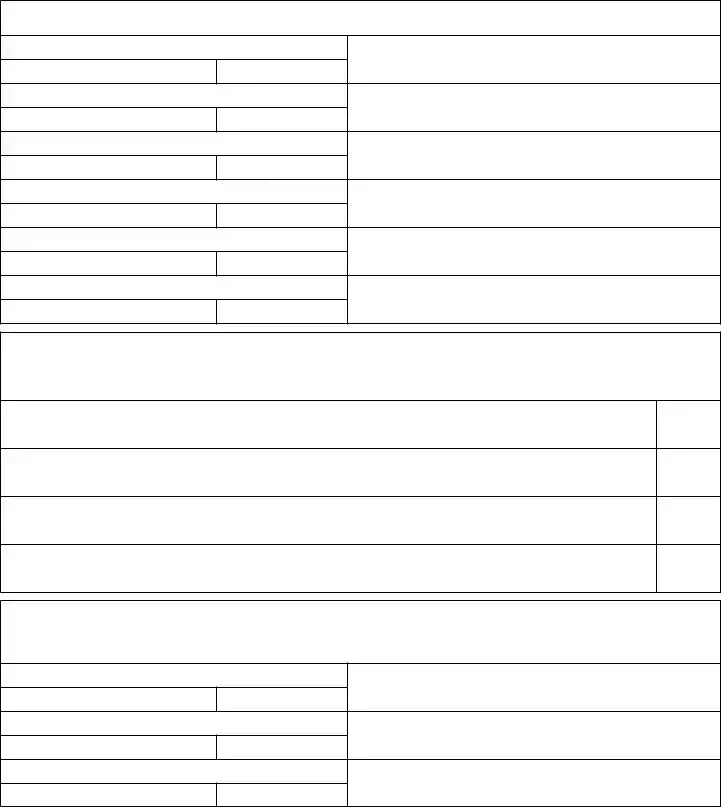

C. List any person who holds a position of managing employee within the disclosing entity.

If more space is needed attach a separate sheet with the required information.

Name

SSN Name

SSN Name

SSN Name

SSN Name

SSN Name

SSN

Position Title

DOB

Position Title

DOB

Position Title

DOB

Position Title

DOB

Position Title

DOB

Position Title

DOB

D. Does any person, business, organization or corporations with an ownership or control interest (identiied in A or B) have an ownership or controlling interest of 5% or more in any other Nebraska Medicaid Provider? If more space is needed attach a

separate sheet with the required information.

Yes |

No If yes, please name and show information. |

||

Name |

|

|

Other Provider Name |

|

|

|

|

SSN/FTIN |

|

DOB |

|

Name |

|

|

Other Provider Name |

|

|||

|

|

|

|

SSN/FTIN |

|

DOB |

|

Name |

|

|

Other Provider Name |

|

|||

|

|

|

|

SSN/FTIN |

|

DOB |

|

Name |

|

|

Other Provider Name |

|

|||

|

|

|

|

SSN/FTIN |

|

DOB |

|

|

|

|

|

%Interest

%Interest

%Interest

%Interest

E. List any person (identiied in A, B, or C) who has an ownership or control interest in the disclosing entity (provider), or is an agent or employee of the disclosing entity (provider) who has ever been convicted of a criminal offense related to that person’s involvement in any program under Medicare, Medicaid, Waivers, CHIP or the Title XX services since the inception of these programs.

If more space is needed attach a separate sheet with the required information.

Name

SSN

Name

SSN

Name

SSN

Conviction Details

DOB

Conviction Details

DOB

Conviction Details

DOB

PROVIDER STATEMENT. I certify that information provided on this form is true, accurate and complete. I will notify Nebraska Department of Health and Human Services of any additions/changes to the information

Sign Here ____________________________________________________________________________________________________

Signature of Provider/Authorized Representative/Agent and Title (Stamped Signature NOT Accepted)

_____________________________________________________________________________________________________________

Print Name |

Date |

Phone Number |

|

|

|

|

|

PAGE 2/3 |

42 C.F.R. Sec. 455.101 Deinitions.

Agent means any person who has been delegated the authority to obligate or act on behalf of a provider.

Disclosing entity means a Medicaid provider (other than an individual practitioner or group of practitioners), or a iscal agent.

Other disclosing entity means any other Medicaid disclosing entity and any entity that does not participate in Medicaid, but is required to disclose certain ownership and control information because of participation in any of the programs established under title V, XVIII, or

XXof the Act. This includes:

(a)Any hospital, skilled nursing facility, home health agency, independent clinical laboratory, renal disease facility, rural health clinic, or health maintenance organization that participates in Medicare (title XVIII);

(b)Any Medicare intermediary or carrier; and

(c)Any entity (other than an individual practitioner or group of practitioners) that furnishes, or arranges for the furnishing of,

Fiscal agent means a contractor that processes or pays vendor claims on behalf of the Medicaid agency.

Group of practitioners means two or more health care practitioners who practice their profession at a common location (whether or not they share common facilities, common supporting staff, or common equipment).

Indirect ownership interest means an ownership interest in an entity that has an ownership interest in the disclosing entity. This term includes an ownership interest in any entity that has an indirect ownership interest in the disclosing entity.

Managing employee means a general manager, business manager, administrator, director, or other individual who exercises operational or managerial control over, or who directly or indirectly conducts the

Ownership interest means the possession of equity in the capital, the stock, or the proits of the disclosing entity.

Person with an ownership or control interest means a person or corporation that—

(a)Has an ownership interest totaling 5 percent or more in a disclosing entity;

(b)Has an indirect ownership interest equal to 5 percent or more in a disclosing entity;

(c)Has a combination of direct and indirect ownership interests equal to 5 percent or more in a disclosing entity;

(d)Owns an interest of 5 percent or more in any mortgage, deed of trust, note, or other obligation secured by the disclosing entity if that interest equals at least 5 percent of the value of the property or assets of the disclosing entity;

(e)Is an oficer or director of a disclosing entity that is organized as a corporation; or

(f)Is a partner in a disclosing entity that is organized as a partnership.

Signiicant business transaction means any business transaction or series of transactions that, during any one iscal year, exceed the lesser of $25,000 and 5 percent of a provider’s total operating expenses.

Subcontractor means—

(a)An individual, agency, or organization to which a disclosing entity has contracted or delegated some of its management functions or responsibilities of providing medical care to its patients; or

(b)An individual, agency, or organization with which a iscal agent has entered into a contract, agreement, purchase order, or lease (or leases of real property) to obtain space, supplies, equipment, or services provided under the Medicaid agreement.

Supplier means an individual, agency, or organization from which a provider purchases goods and services used in carrying out its responsibilities under Medicaid (e.g., a commercial laundry, a manufacturer of hospital beds, or a pharmaceutical irm).

Wholly owned supplier means a supplier whose total ownership interest is held by a provider or by a person, persons, or other entity with an ownership or control interest in a provider.

42 CFR § 455.102 Determination of ownership or control percentages.

(a)Indirect ownership interest. The amount of indirect ownership interest is determined by multiplying the percentages of ownership in each entity. For example, if A owns 10 percent of the stock in a corporation which owns 80 percent of the stock of the disclosing entity, A’s interest equates to an 8 percent indirect ownership interest in the disclosing entity and must be reported. Conversely, if B owns 80 percent of the stock of a corporation which owns 5 percent of the stock of the disclosing entity, B’s interest equates to a 4 percent indirect ownership interest in the disclosing entity and need not be reported.

(b)Person with an ownership or control interest. In order to determine percentage of ownership, mortgage, deed of trust, note, or other obligation, the percentage of interest owned in the obligation is multiplied by the percentage of the disclosing entity’s assets used to secure the obligation. For example, if A owns 10 percent of a note secured by 60 percent of the provider’s assets, A’s interest in the provider’s assets equates to 6 percent and must be reported. Conversely, if B owns 40 percent of a note secured by 10 percent of the provider’s assets, B’s interest in the provider’s assets equates to 4 percent and need not be reported.

PAGE 3/3

File Information

| Fact Name | Description |

|---|---|

| Governing Laws | This form is governed by the Centers for Medicare and Medicaid Services regulations, specifically 42 CFR 455.100 to 42 CFR 455.106. |

| Purpose | The MLTC 62 form is used to disclose ownership and controlling interests, as well as any criminal convictions related to Medicare and Medicaid programs. |

| Submission Timeline | Disclosure must occur at enrollment, during a survey, or within 35 days of a written request from the Nebraska Department of Health and Human Services. |

| Entity Identification | Providers must provide their legal name, address, and other identifying information, including their NPI and provider numbers. |

| Ownership Disclosure | Individuals with a 5% or greater ownership interest in the disclosing entity or any subcontractor must be listed, along with their personal details. |

| Related Persons | The form requires disclosure of any relationships between persons with ownership interests, such as familial ties. |

| Managing Employees | It also requires listing of managing employees within the disclosing entity, along with their titles and relevant information. |

| Criminal Convictions | Any person with an ownership interest who has been convicted of a relevant criminal offense must be disclosed, including details of the conviction. |

| Provider Statement | A certification statement at the end of the form ensures that the information provided is accurate and complete, requiring a signature from the provider or authorized representative. |

Other PDF Templates

Nys Notary Practice Exam Pdf - Stay up to date with the latest notarial procedures and guidelines issued by the Nebraska Secretary of State to ensure compliance.

For LLCs in Texas, having a well-drafted Operating Agreement is crucial, and you can find the necessary template at Texas Documents, which will guide you through establishing a clear operational framework tailored to your specific needs.

Nebraska Fuel Tax - Form 84AG requests contact details for a smooth correspondence, ensuring any queries regarding the application can be promptly addressed.